establishment of a company

Our team of experts is here to help you set up a company in different countries around the world, including the USA, UAE, Cyprus and many more.

We provide you with comprehensive consulting services that will help you deal with business challenges. Our consultants are trained to provide expert advice tailored to your needs and your budget.

We offer support to both beginners in business and experienced entrepreneurs. Our goal is to help you achieve your business goals and be confident in your business.

Our clients receive professional advice that will help you make smart decisions and achieve greater success in business. You may pay a few hundred dollars more for our services, but it will pay off in the long run.

We are a consulting firm that deals with establishing companies and providing consulting in the field of business. Our team of experts monitors all changes in the laws of the countries where we establish companies and informs our clients about all relevant changes. In this way, your business will always be adapted to the latest regulations, which will help you avoid fines and penalties.

With our experience and knowledge, we can provide quality support in various areas of business, including tax consulting, financial management, marketing and business strategy. Our consultants will work with you to develop a customized plan for your business that is geared towards achieving your goals.

Contact us today and find out how we can help your business adapt to new changes and regulations. We will work with you to develop a customized plan for your business that will comply with all applicable laws and regulations.

Income tax is the single most important source of revenue for the UK Treasury. It is forecast to raise around £200 billion in 2023.

Privacy is the ability of an individual or group to seclude themselves or information about themselves and thereby express themselves selectively.

Assets that are shielded from creditors by law are few: common examples include some home equity, certain retirement plans, and interests in LLCs.

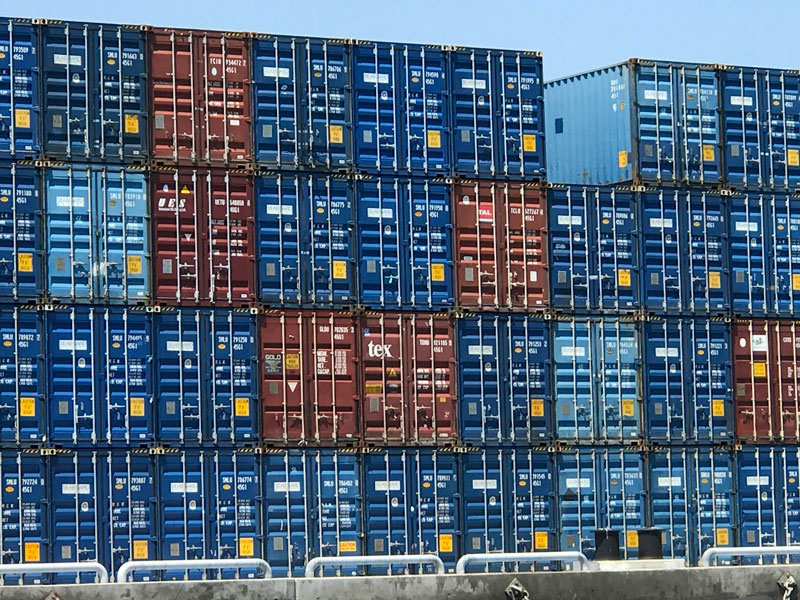

Taking part in international business can cause certain limitations, due to the residence of the country, you are settled in. Forming an international company in either offshore or onshore jurisdiction can ease, or completely free you of any problems, that your domestic company may have when entering certain markets or doing certain businesses.

Still, to implement such business structures successfully, a wide range of issues will arise, frequently relating to subjects such as the opening of bank accounts, due diligence, and KYC (Know Your Client) procedures, that are necessary for today’s regulatory and banking procedures, you will need a help of a professional.

INTERNATIONAL BUSINESS

Whether you need to form an easy single-member company plus bank account, or a complicated business structure, in order to obtain all the vehicles of a successful business, and achieve maximum, we suggest that you hire skilled help.

The terms, such as provisions of anti-avoidance agreements and access to double tax agreements, controlled foreign company and management, and control tests and stipulations, transfer pricing, narrow capitalization, participation indemnity, capital gains tax, and a multitude of other ever-changing regulations, can stay unfamiliar to you.

Lately, there are changing demands for the end user/owner of the company, new exchanges of information, and new reporting standards, so be careful when you choose a formation agent. Nowadays, the offshore world involves the skilled implementation of certain rules, and when set up correctly, you should not have a headache with your new company. We, as a formation agent of companies, for almost 20 years, will strive to make your offshore business experience, as problem-free as possible!

You can reach out to Aleksandar at Linkedin

Aleksandar Dobromirov is a highly respected and knowledgeable expert in the field of offshore company formation. With 25+ years of experience and a deep understanding of the intricacies involved in setting up offshore companies, he has become a sought-after advisor and consultant for individuals and organizations looking to expand their operations into new and potentially lucrative markets.

Offshore company formation can be a complex and challenging process, requiring a deep knowledge of the legal, financial, and regulatory requirements in the country or countries where the company will be operating. This is where Aleksandar Dobromirov excels, as he has a wealth of experience in helping clients navigate these complex waters. During his life and career, Aleksandar lived in Serbia, Israel, Greece, Hungary and Austria.

One of the key factors that sets Aleksandar Dobromirov apart from his peers is his ability to understand the unique needs of each of his clients. He takes the time to listen to their goals, assess their financial situation, and work with them to create a customized solution that will help them achieve their objectives. He also has a strong network of contacts and partnerships with reputable professionals in various fields such as accounting, law, and banking, which enables him to offer a comprehensive and streamlined service to his clients.

Another area where Aleksandar Dobromirov excels is his ability to stay abreast of the latest changes and developments in the world of offshore company formation. The legal and regulatory landscape in this field is constantly evolving, and he is always at the forefront of these changes, ensuring that his clients receive the most up-to-date and accurate advice and guidance.

In addition to his technical expertise, Aleksandar Dobromirov is known for his exceptional customer service and dedication to his clients. He is always available to answer questions and provide support, and goes above and beyond to ensure that his clients are completely satisfied with the services they receive.

In conclusion, Aleksandar Dobromirov is a highly skilled and knowledgeable expert in the field of offshore company formation. His combination of technical expertise, customer service, and a deep understanding of his clients’ needs make him an exceptional advisor and consultant, and a trusted partner to those looking to expand their operations into new and potentially lucrative markets.

With many ready-made solutions for the reduction of costs, we arrange for our clients to choose from our pool of proven suppliers of services. Our idea is that a customer’s business formation costs should be fixed, predictable, and affordable.

And, our customers should get a lot of value for their money. Our fee structure is transparent, easy to understand, and without any surprises. This is in sharp contrast to other companies, our competitors, some of which hide the true nature of their fees.

Lifetime customer support that goes well beyond just business formation matters and assumes the role of a knowledgeable, experienced friend standing by, to answer questions and help business owners make informed decisions. With our state-of-the-art infrastructure, our offshore center works as a virtual extension of our customer’s needs providing 24×7 service.

Euro Commerce LLC is registered in 2001, under the Delaware Division of Corporations Permanent File #: 33623-95

Money laundering is a serious crime that has far-reaching negative consequences on society. It facilitates crime, drug trafficking, human trafficking, terrorism, and other illegal activities.

As a responsible business, we are committed to preventing money laundering and terrorist financing by implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

These measures ensure that we identify and verify the identity and suspicious activities of our clients. We do not accept such clients. By doing so, we are contributing to the global fight against financial crime and helping to create a safer and more secure world.

Find out more about what we can do for you…